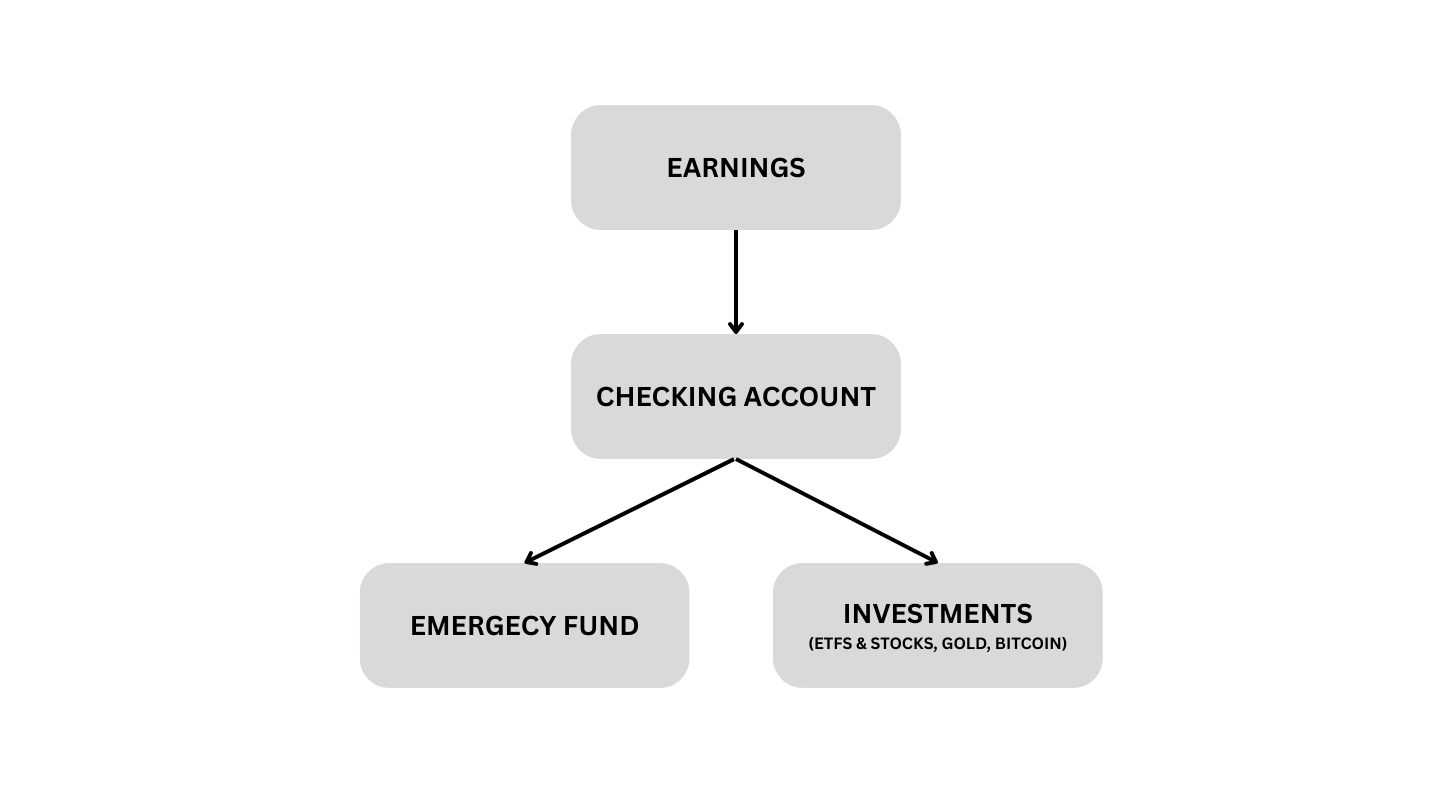

Managing personal finances can be challenging, especially when income and expenses fluctuate. However, one effective way to gain control over your money is by using the Three Account Model. This is because this method helps individuals manage their finances efficiently by dividing their income into three separate accounts, each serving a specific purpose.

DISCLAIMER: NO FINANCIAL ADVICE, ENTERTAINMENT PURPOSE ONLY

What is the Three Account Model?

The Three Account Model is a simple yet effective financial management strategy that automates your income into your emergency and savings funds. The three accounts are:

Account for daily expenses

This account is a dedicated bank account used to manage everyday spending, such as groceries, transportation, dining out, and other routine costs. In this way, this account ensures that essential and discretionary expenses are covered without dipping into savings or long-term investments. By doing so, individuals can track their spending more effectively and maintain better financial discipline.

Moreover, many people allocate a specific percentage of their income to this account each month and use budgeting apps or expense trackers to monitor their transactions. As a result, this approach helps prevent overspending and ensures that enough money is available for necessities while still allowing for occasional indulgences.

Account for emergency fund

This account is reserved exclusively for unforeseen expenses and financial emergencies — think medical bills, urgent home repairs, or unexpected job loss. Importantly, it’s not meant to be touched for regular spending or planned purchases. The goal of this account is to provide a financial safety net that offers peace of mind during times of uncertainty.

Therefore, experts typically recommend setting aside three to six months‘ worth of living expenses in this account, although the exact amount depends on individual circumstances and risk tolerance.

By keeping this money in a separate, easily accessible account — such as a high-yield savings account — you ensure that it’s available when needed, but at the same time, not so easily reachable that you’re tempted to use it for non-emergencies.

Granted, building an emergency fund takes time, but regular monthly contributions, even small ones, add up over time and can make a huge difference in times of crisis.

Account for investing

Once your daily expenses are under control, your emergency fund is solid, and you’re regularly saving toward your goals, the next step is to start building long-term wealth — and that’s where an investment account comes into play. This account is dedicated to growing your money over time through investments in assets like stocks, ETFs, bonds, or real estate.

Unlike your emergency fund or short-term savings, the money in your investment account isn’t meant to be accessed quickly. It’s for your future — retirement, financial independence, or big-ticket goals ten or more years down the line. The key here is the power of compound interest: the longer your money stays invested, the more it can grow.

By having a separate account strictly for investing, you avoid the temptation to dip into your long-term funds for short-term wants. Additionally, it gives you a clearer picture of how your financial future is shaping up.

Even if you can only make small, consistent contributions — say, five to ten percent of your income — it can lead to significant results over time.

How to handle it?

A good advice here is to keep it simple. Therefore, don’t overdo it with more than these three accounts in the beginning, and instead, focus on starting to save money. Here is how to begin with this model:

Get out of debt

If you have debt, pay it off as soon as you can before starting to invest something.

Fill up your emergency fund

Open up an investment account and find some cheap ETFs (exchange-traded funds) like the MSCI World and MSCI Emerging Markets. Allocate around five to ten percent of your income into it. Additionally, an investment in Bitcoin might be a good thing too, if you can afford it.

Enough money saved – now start investing

Open up an investment account and find some cheap ETFs (exchange-traded funds) like the MSCI World and MSCI Emerging Markets. Allocate around five to ten percent of your income into it. Additionally, I would start investing in Bitcoin too — also five to ten percent, if you can afford it. More about the importance of Bitcoin here.

Do this automated every month. Fortunately, most accounts can give you automated transactions at the beginning or ending of the month. That’s it!

Conclusion

In the end, managing your finances doesn’t have to be complicated. The Three-Account Model is a simple yet powerful strategy to take control of your money, reduce stress, and make steady progress toward your goals. By consciously separating your income into clear, purpose-driven accounts, you create structure and intention around your spending and saving habits.

Remember: simplicity is key. You don’t need a complex financial system to build a strong foundation — just a consistent approach and a bit of discipline. Ultimately, implementing this model is a small change with a big impact. It’s not just about money management; it’s a step toward personal freedom and long-term independence.

Start small, stay consistent, and let this system work for you.

DISCLAIMER: This post is for entertainment purposes only, no financial advice!

Schreibe einen Kommentar